Adjustable rate mortgage calculator with balloon payment

Our calculator includes amoritization tables bi-weekly savings. 1 How much income you need to qualify for the mortgage or 2 How much you can borrow or 3 what your total monthly payment will be for the loan.

Extra Payment Mortgage Calculator For Excel

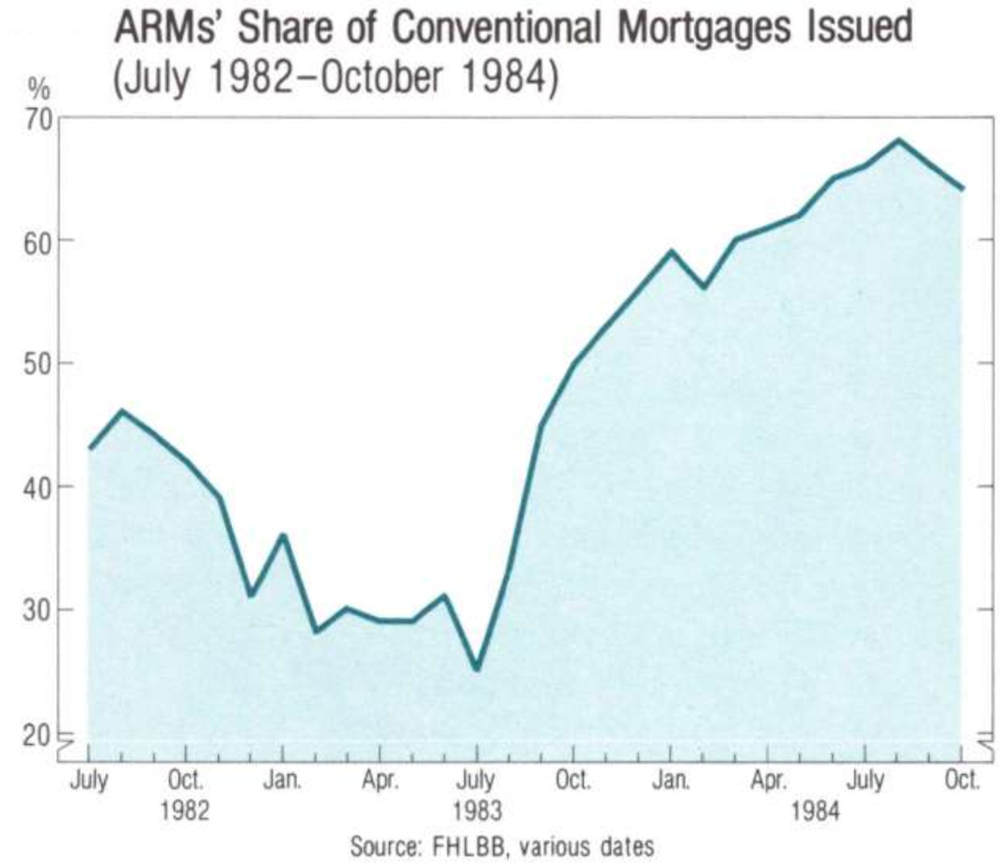

This cap says how much the interest rate can increase the first time it adjusts after the fixed-rate period expires.

. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. Name of lender or broker contact information. The extra amount you want to pay towards the principal each month a regularly scheduled prepayment.

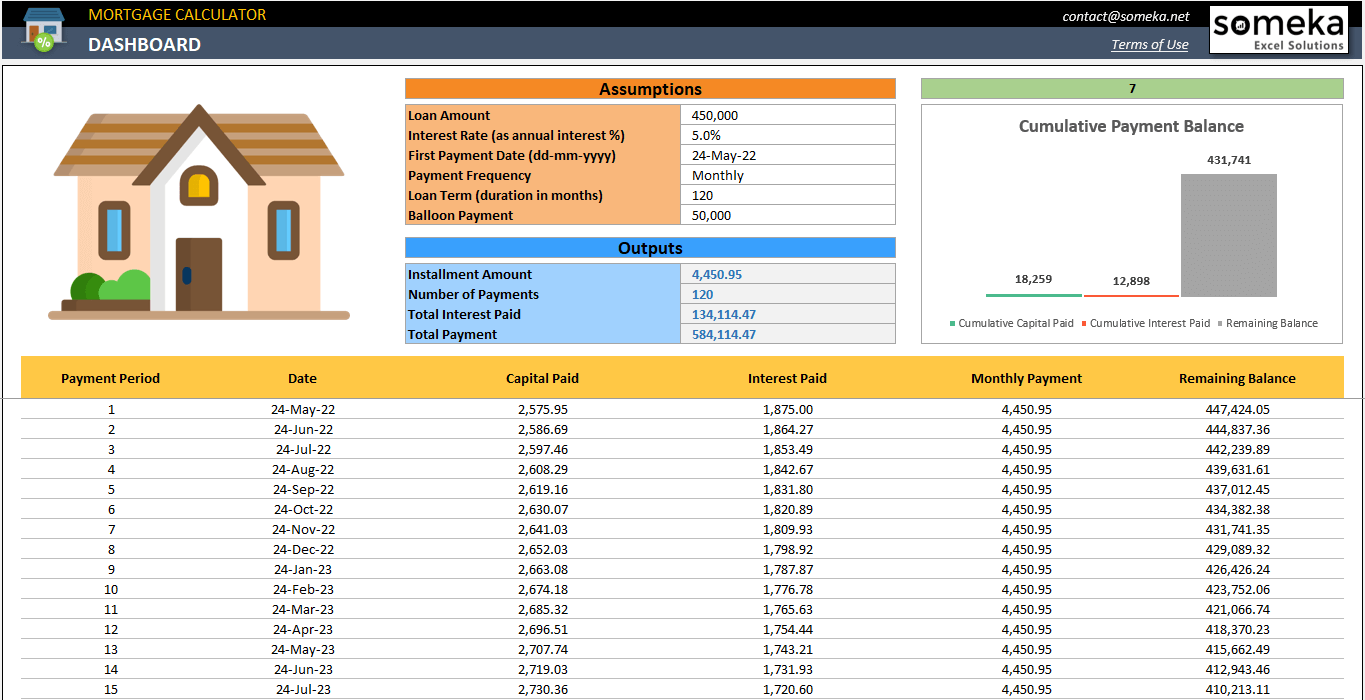

For a biweekly payment it is divided by 26 while a monthly payment is divided by 12. Using the calculator above lets estimate your monthly principal and interest payment total monthly payment total interest cost and ending balloon payment. To use our mortgage calculator slide the adjusters to fit your financial situation.

Balloon payment is always higher than monthly payments. To use this calculator just enter the original mortgage principal annual interest rate term years and the monthly payment. There are three kinds of caps.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. You must make the balloon payment by the end of the 3-year term. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie.

Name of lender or broker contact information. Provisions are straightforward and payments are based off the current interest rate or if its an adjustable rate mortgage the payments may. Thinking of getting a variable rate loan.

Monthly Mortgage Payment PI. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment.

Free calculators for your every need. Fractional points are commonly used by lenders to round off a rate to a standard figure such as 475 percent rather than something like 4813 percent. The loans interest rate.

Its common for this cap to be either two or five percent meaning that at the first rate change the new rate cant be more than two or five percentage points higher than the initial rate during the fixed. It is set to No by default. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Consists of both principal P and interest I. Require a balloon payment to cover the remaining balance. Balloon payment mortgages are a special kind of mortgage where you are left with a large payment at the end of the loan.

It also has a distinct feature. Mortgage rates valid as of 19 Jul 2022 0933 am. The loan is secured on the borrowers property through a process.

On the Extra PaymentsInvestment Rate tab please see Is a Regular Payment Due Today This setting impacts the analysis. This calculator will compute the payment amount for a commercial property giving payment amounts for P I Interest-Only and Balloon repayment methods -- along with a monthly amortization schedule. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3.

A balloon mortgage can be an excellent option for many homebuyers. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Adjustable Rate Mortgage Calculator.

Scroll down the page for more detailed guidance on using this mortgage calculator and frequently asked. Take out a three or five-year loan then face a balloon payment. For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables.

R the periodic interest rate. This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3.

Why you need a wealth plan not a financial plan. A balloon mortgage is usually rather short with a term of 5 years to 7 years but the payment is based on a term of 30 years. Though it comes with an adjustable interest rate it lets you withdraw funds only and when you need them.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. It could amount to 2 times the monthly payment but it could also be thousands of dollars. Then choose one of the three options for calculating the number of mortgage payments made leave two of the options blank to determine the remaining balance.

The loan amount is 800000 with an 8 percent APR. A monthly payment is multiplied by 12 resulting in 360 payments. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. Derived from the amount borrowed the term of the loan and the mortgage interest rate. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Increases over time as interest accrues. Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments. Or adjustable-rate mortgages ARM.

Fixed-rate mortgage interest rate and annual. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Fixed-rate mortgage interest rate and annual.

As the name implies interest rates remain the same for the term of the FRM loan. The regular payment amount. Use this calculator to figure your expected monthly payments before and after the reset period.

The calculator will use the terms of your loan for the analysis. N the total number of payments. This assumes no penalties for making prepayments.

To help you see current market conditions and find a local lender current Redmond traditional ARM rates are published in a table below the calculator. To determine what that balloon payment will be you can download the free Excel template below which calculates the regular monthly payment and balloon payment for a. There is also one other setting to be aware of.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. A balloon loan or balloon mortgage payment is a payment in which you plan to pay off your auto or mortgage loan in a big chunk after a number of small regular monthly payments. The unused portion of the credit grows over time.

This means that the mortgage does not fully amortize over its lifespan. Debt Changes Over Time. Check out the webs best free mortgage calculator to save money on your home loan today.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Adjustable Rate Mortgage Calculator Rate Change On Any Day

Pay Option Adjustable Rate Mortgage Calculator

How To Calculate A Balloon Payment In Excel With Pictures

Adjustable Rate Mortgage Payment Calculator With Schedule

Sdj0vcpuql1c7m

Balloon Loan Calculator Single Or Multiple Extra Payments

Pay Option Adjustable Rate Mortgage Calculator

Free Interest Only Loan Calculator For Excel

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Adjustable Rate Mortgage Calculator Rate Change On Any Day

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Loan Originator Mortgage Infographic

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Online Mortgage Calculator Wolfram Alpha