21+ Early mortgage payoff

Paying Off Mortgage Early before the end of the term of the home loan is every homeowners dream. To pay off their mortgage 21 years early they made two moves to shave years off their mortgage and decrease the interest they owed.

1

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

. Payment estimate is for a loan to purchase a primary residence. If you pay the minimum amount due every month it will take you 30 years to pay off the outstanding loan amount. Make a 13th payment each year.

-To make a payment by phone please call 800-955-0021 and speak with any financial counselor. Subject to lender terms and conditions. A variation is to divide the regular payment amount by 12 and add that amount to each monthly payment.

Payments must be made by speaking with a financial counselor and completing a Check-by-Phone using the customers checking or savings account. How much interest can you save by increasing your mortgage payment. Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage.

There are several ways that you can pay off your mortgage sooner that the term of your contract. Most people do not know the fact that it takes 21 years to pay just half of the mortgage amount if your just pay the level monthly payment. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan.

Most home mortgages are 30-year fixed-rate mortgages. Not all applicants will qualify. For example if you have a 30-year fixed-rate mortgage for 300000 at a mortgage rate of 5 and you make regularly scheduled payments you will pay 1610 each month for a total of 579767.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The mortgage payoff calculator helps you find out. Mortgage Refinance Calculator Early Payoff Aug 2022.

Homeowners Dream of Owning a Home with no Mortgage Loan Balance. EST Monday - Friday except Federal Public Holidays. A common early loan payoff strategy is to make an additional principal payment each year.

Find out how much interest you can save by paying an additional amount with your mortgage payment. You save money on long-term interest. Then enter the loan term which defaults to 30 years.

The additional amount will reduce the principal on your mortgage as well as the total amount of interest you will pay and the number of payments. Mortgage Refinance Calculator Early Payoff - If you are looking for a way to lower your expenses then we recommend our first-class service. They used a simple calculation to make 2 painless extra.

Depending on your balance and how long you have left on your loan paying it off early could save you significantly on interest costs. Actual term rate APR and loan amount may vary. Please enter original loan amount value between 01 to 9999999999.

5 ways to pay off your mortgage early. Ad Shortening your term could save you money over the life of your loan. Use Casaplorers amortization calculator to understand how the amortization process works and how it affects your interest costs.

How Much Interest Can You Save By Increasing Your Mortgage Payment. For actual payment rates and term contact 21st Mortgage at 800-955-0021 and speak to one of our loan originators. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

There are two ways you can make extra mortgage payments to accelerate the payoff process. The addition of just a few hundred dollars each month can cut years from the time it takes you to pay off your mortgage. -Payment must be completed by 1000 pm.

You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. Ive been asked dozens of times to share how far along I am in my mortgage pay off journey so today Im going to share my debt pay off progress after 2 years. Paying your mortgage early requires dedication and proper strategic planning.

Lets take a look.

Monthly Payment Contract Template Free Loan Agreement Templates Word Pdf Lab Contract Template Personal Loans Lettering

Pros And Cons Of Downsizing Your Home Downsizing Financial Independence Retire Early Financial Independence

How To Celebrate Paying Off Your Mortgage Early Mortgage Budget Planning Mortgage Free

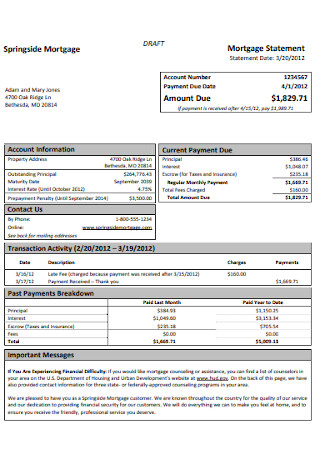

Mortgage Statement 10 Examples Format Pdf Examples

Handover Certificate Template 13 Templates Example Templates Example Certificate Templates Blank Certificate Template Templates

1

1

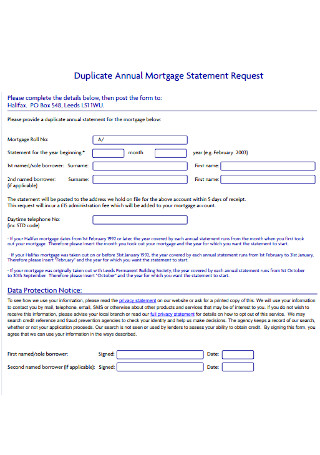

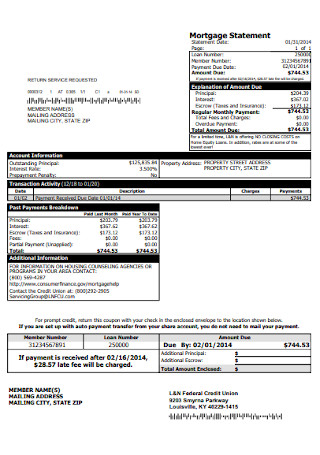

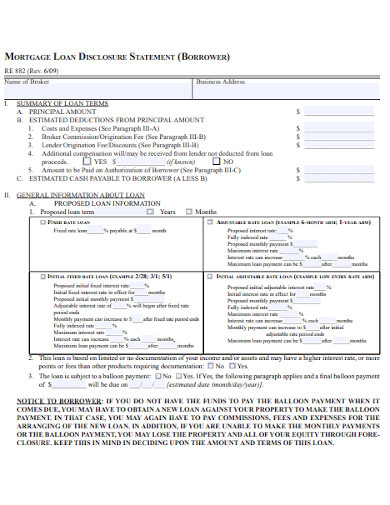

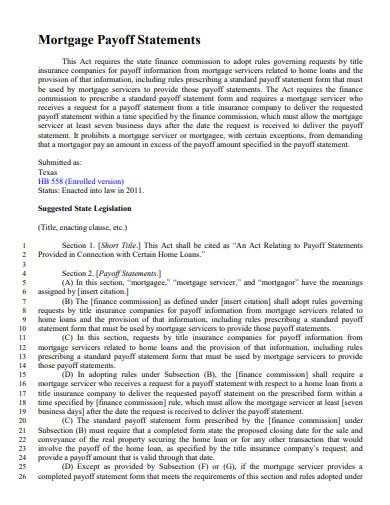

21 Sample Mortgage Statement Templates In Pdf Ms Word

1

21 Sample Mortgage Statement Templates In Pdf Ms Word

21 Sample Mortgage Statement Templates In Pdf Ms Word

21 Sample Mortgage Statement Templates In Pdf Ms Word

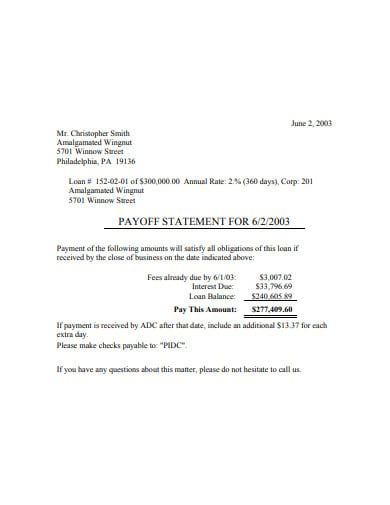

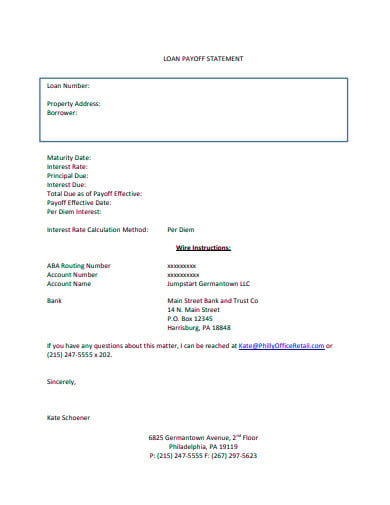

13 Payoff Statement Templates In Pdf Free Premium Templates

Mortgage Statement 10 Examples Format Pdf Examples

13 Payoff Statement Templates In Pdf Free Premium Templates

21 Mortgage Statistics That Come As No Surprise In 2022

Mortgage Statement 10 Examples Format Pdf Examples